- COMPARE AUTO INSURANCE RATES MICHIGAN DRIVERS

- COMPARE AUTO INSURANCE RATES MICHIGAN DRIVER

- COMPARE AUTO INSURANCE RATES MICHIGAN FULL

- COMPARE AUTO INSURANCE RATES MICHIGAN LICENSE

According to data from The Zebra, the most expensive Michigan cities for coverage include: The place where you park your vehicle every night plays a big part in how much you pay for auto insurance.

COMPARE AUTO INSURANCE RATES MICHIGAN DRIVERS

The Zebra reports that you can potentially save thousands on your auto insurance if you have an outstanding credit score compared to the available rates for drivers with poor credit. Michigan Auto Insurance Premiums by Credit Tier

COMPARE AUTO INSURANCE RATES MICHIGAN LICENSE

$5070 for driving with an open alcohol container.$4049 for operating someone else's vehicle without permission.On average, your insurance will increase as follows after these common violations: The Zebra notes that you can save up to 57 percent on your auto policy in Michigan if you have no recent at-fault accidents, compared to a savings of 50 percent nationwide. Average Michigan Insurance Rates After A Violation or Accident Married drivers receive a slight price break on their Michigan auto coverage premiums of about $37 annually, compared to $98 lower rates for married drivers compared to single drivers across the U.S. According to The Zebra, the average annual cost for women drivers is $3164 compared to $3096 for male drivers. Your car insurance rates in Michigan vary based on gender. Michigan Car Insurance Premiums by Gender and Marital Status

COMPARE AUTO INSURANCE RATES MICHIGAN FULL

The average rate for this age group is 107 percent more than the Michigan average for minimum coverage and 136 percent more than the state average cost for full coverage.

New drivers, especially teens and 20-somethings, pay significantly more than average for auto insurance than older drivers do, according to The Zebra.

COMPARE AUTO INSURANCE RATES MICHIGAN DRIVER

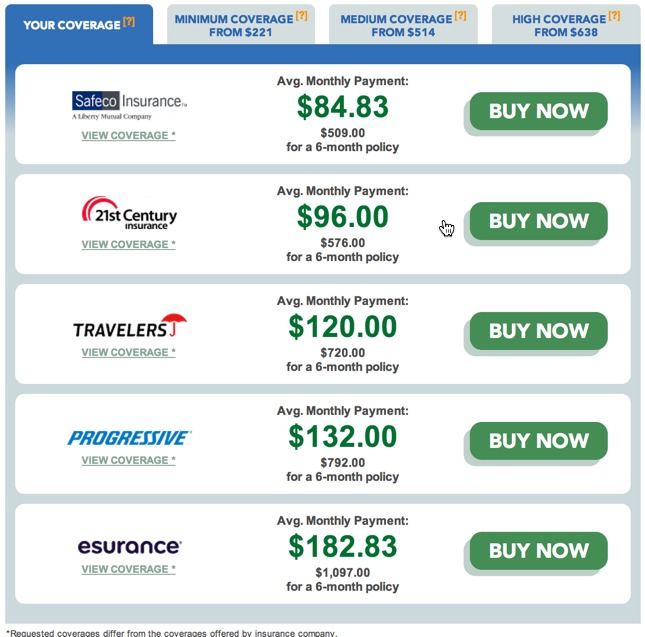

Michigan Auto Insurance Premiums by Driver Age Michigan Auto Insurance Costs by Insurerĭata from ValuePenguin list these companies as the most affordable options for Michigan car insurance, with these average annual rates: Review our guide to help narrow your search for affordable auto insurance coverage in the state. Drivers who live here pay an average of $995 per year for minimum coverage and $2375 for full coverage, compared to the average of $1738 across the United States for full coverage. Bankrate reports that drivers in Michigan have the second-highest auto coverage rates in the nation.

0 kommentar(er)

0 kommentar(er)